Protocol Overview

Darkmatter was engineered to eliminate the single points of failure inherent in traditional market structures. We provide a fortress for sovereign commerce, enforced by cryptography and powered exclusively by Monero.

Operational History

Initializing in late 2023, Darkmatter Protocol was deployed as a direct response to the increasing sophistication of blockchain analysis and traffic correlation attacks. Unlike legacy markets that prioritized scaling over security, Darkmatter was built on a "security-first" doctrine.

Our infrastructure utilizes a decentralized node network that distributes load balancing across multiple hostile jurisdictions. This architecture ensures that even if individual nodes are seized, the core database remains encrypted and inaccessible, preserving user anonymity and operational continuity.

Core Philosophy

We adhere to the principle that financial privacy is a fundamental human right, not a crime. This necessitates the exclusive integration of Monero (XMR). Bitcoin and other transparent ledger currencies expose users to chain analysis heuristics that can de-anonymize transactions years after they occur.

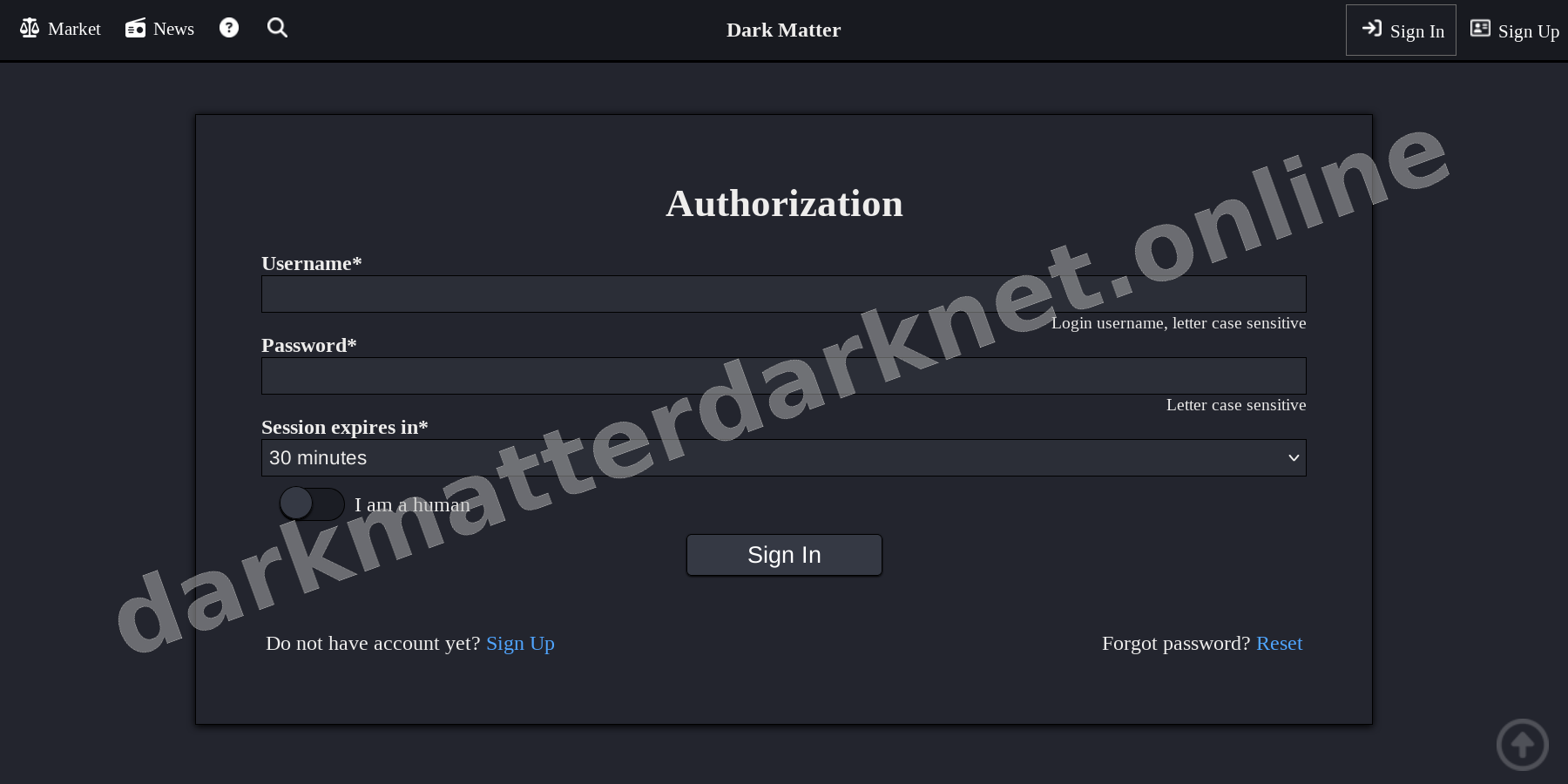

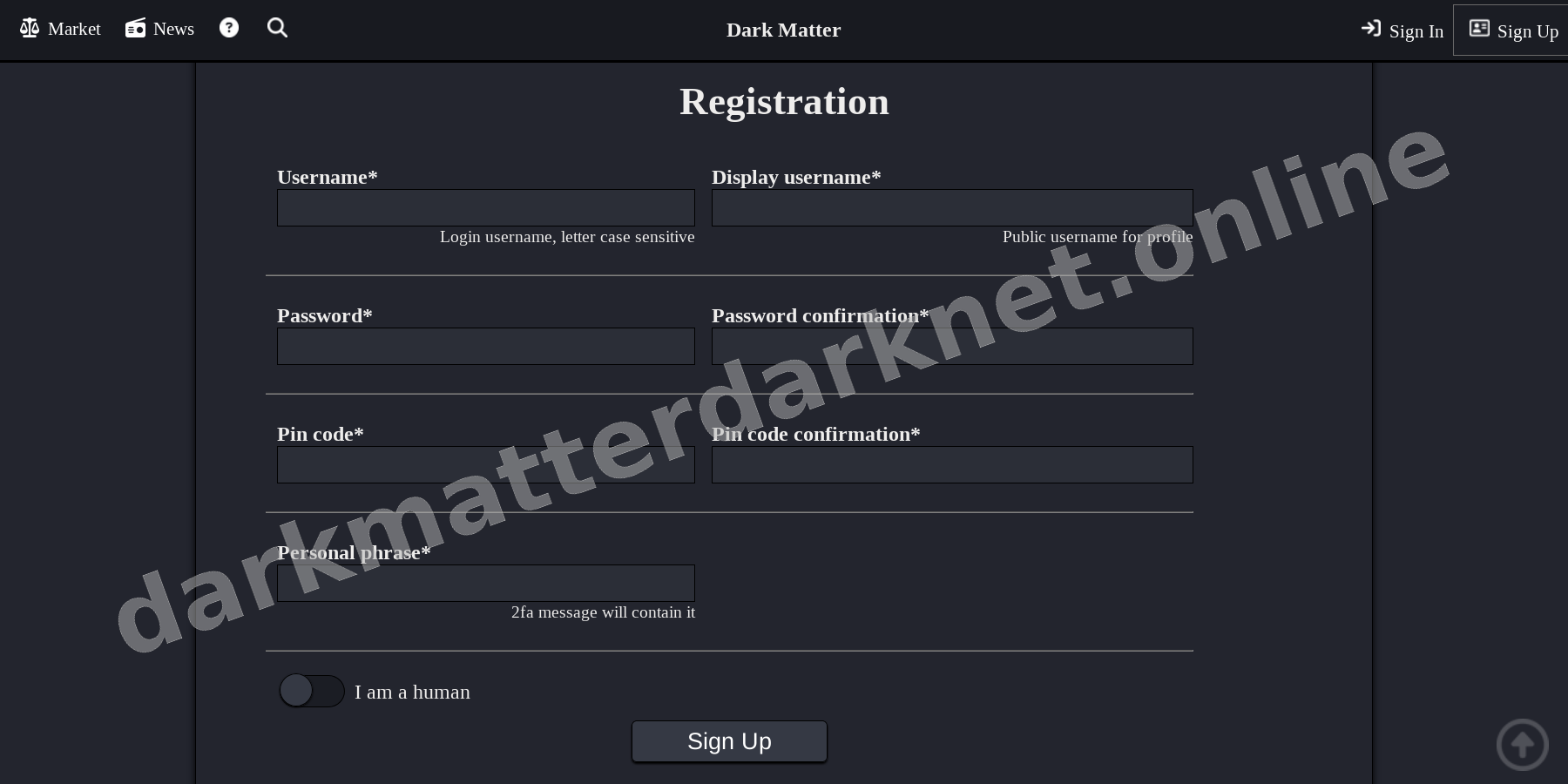

Darkmatter enforces a "Zero-Trust" environment. We do not trust users, and users should not trust us. Instead, we trust mathematics. PGP encryption is mandatory for 2FA and sensitive communications, and our escrow system is governed by rigid code contracts rather than human discretion wherever possible.

Interface Visuals

Anti-DDoS Gateway

SECURE

Encrypted Login

PGP 2FA

Anonymous Registration

NO LOGS

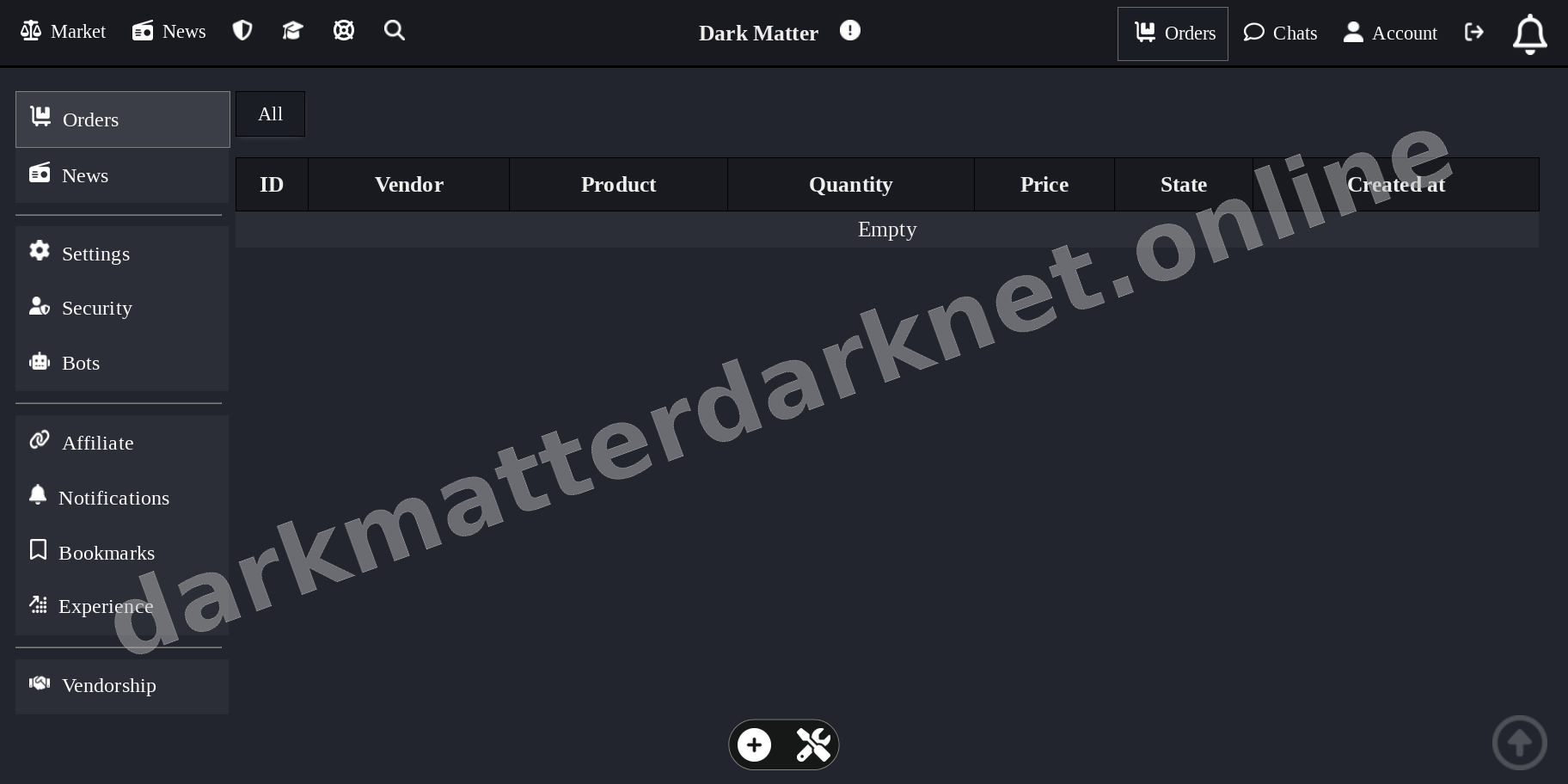

Marketplace Grid

LIVETechnical Specifications

OpSec & Encryption

Darkmatter employs zero-knowledge transaction verification. Funds and escrow states are validated without exposing raw transaction data to server logs. All server-client communication is stripped of metadata, and mandatory PGP encryption ensures a sealed environment for all sensitive data exchanges.

Monero Architecture

We support strictly XMR to negate privacy leakage associated with transparent blockchains. Our implementation utilizes XMR subaddresses for unique deposit generation and multisig wallets for escrow, ensuring that neither the buyer, vendor, nor market can unilaterally move funds without consensus.

Dispute Resolution

Our hybrid dispute system utilizes algorithmic analysis of vendor metrics and shipping data to provide initial rulings. This accelerates resolution times by 65%. Complex cases are escalated to human moderators who utilize PGP-signed evidence to reach a final, immutable verdict.

Vendor Vetting Protocol

-

01

Reputation Import

Vendors must provide PGP-signed proof of established history on recognized legacy platforms to bypass initial restriction tiers.

-

02

OpSec Assessment

Mandatory technical audit of vendor PGP key strength (RSA-4096 min) and operational security practices.

-

03

Liquidity Bonding

Vendors deposit a bond (up to 2.00 XMR) into a locked wallet. This bond is slashed in cases of proven fraud or exit scamming.

Escrow Dynamics

Funds are held in a 2-of-3 multisig wallet. Release requires signatures from two parties: Buyer+Vendor (successful trade) or Market+Buyer/Vendor (dispute).

Restricted to vendors with >500 successful trades and 99% positive feedback. Reduces market risk exposure.

Initiate Secure Connection

Verify your connection path using our official PGP keys. Ensure you are accessing a verified onion mirror to prevent MITM attacks.